Get tailor-matched with top-rated,regulated,trusted,verified CFD brokers

Aligned with your trading profile

Top broker matches for traders in South Africa

Our matching system highlights brokers based on your preferences, experience level, and priorities… helping you narrow down the right options faster.

/ 5

Score out of 2,500: This reflects how many South African traders would likely match with this broker, based on an algorithm that compares the broker’s offering to the typical needs of South African traders.

/ 5

Score out of 2,500: This reflects how many South African traders would likely match with this broker, based on an algorithm that compares the broker’s offering to the typical needs of South African traders.

/ 5

Score out of 2,500: This reflects how many South African traders would likely match with this broker, based on an algorithm that compares the broker’s offering to the typical needs of South African traders.

/ 5

Score out of 2,500: This reflects how many South African traders would likely match with this broker, based on an algorithm that compares the broker’s offering to the typical needs of South African traders.

Choose better.

Trade better.

The TradeFX app gives you more than broker comparisons.

It’s your gateway to expert insights, platform deep-dives, exclusive content, and rewards… all designed to help you become a more informed, confident trader.

This is where learning meets smarter decision-making.

We help you choose. You stay in control.

Compare

Compare brokers by regulation, fees, platforms, asset classes, and support... all in a clear, structured format.

Learn

Access educational articles and platform insights designed to help you understand your options before committing to a broker.

Match

Our matching system surfaces brokers aligned with your goals, location, and experience level.

Built on transparency and regulation

TradeFX is a broker comparison and matching platform built with compliance at its core. While we are not a broker and do not provide trading services, we operate transparently and disclose all commercial relationships.

- Regulated business entity

- Clear affiliate disclosures

- No trading or fund handling

- Data privacy & security focused

Learn more.

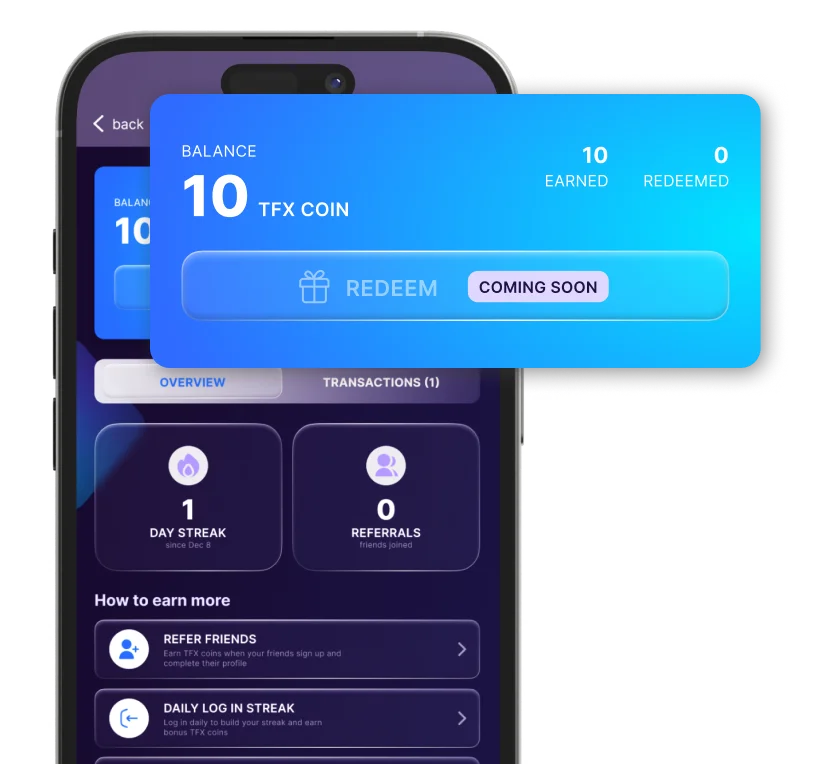

Earn more.

TradeFX rewards engagement and learning.

Earn TFX coins by reading articles, completing educational content, and exploring broker insights… unlocking exclusive benefits along the way.

Trusted by traders

who chose better

Daniel M.

Easy to use and straightforward. Helped me compare brokers without digging through endless websites.

Sarah vd M.

I liked that everything was explained clearly. It made choosing a broker much less confusing.

Thabo N.

Simple platform that does what it says. The comparisons saved me time.

Liam J.

Helpful for narrowing down broker options, especially for beginners.

Clarity before you decide

Talk to the TradeFX team

Have a question or need help navigating broker options?

Our team is here to help.

Want to partner with us?

Let’s have a conversation.

ASK PIP