Every day, over $9.6 trillion changes hands in the global foreign exchange (forex or FX) market — making it the largest and most liquid financial market in the world.

Whether you’ve exchanged money for a vacation abroad or purchased an item priced in another currency, you’ve already participated in forex trading at a basic level.

Forex trading is the act of buying one currency while simultaneously selling another, aiming to benefit from fluctuations in exchange rates.

Unlike stock markets that close each day, the forex market operates 24 hours a day, five days a week, across major financial centres like London, New York, Tokyo, and Sydney.

This constant activity means there’s always an opportunity somewhere in the world’s currency markets.

For many, forex provides not just a way to trade global economies — but a means to diversify portfolios and hedge against inflation or currency risk.

In this complete guide, you’ll learn everything you need to know about forex trading — from key concepts like pips, leverage, and spreads to trading strategies, risk management, and market psychology.

Whether you’re a beginner or looking to refine your knowledge, this article will give you the foundation to navigate the dynamic world of currency markets confidently.

What is Forex Trading?

Forex trading, short for foreign exchange trading, is the process of exchanging one currency for another with the goal of profiting from changes in their relative values.

When you trade forex, you are simultaneously buying one currency while selling another — always as part of a currency pair.

The foreign exchange market is a decentralised global network where currencies are traded electronically through banks, brokers, financial institutions, and individual traders.

It is the largest and most liquid financial market in the world, with an estimated average daily turnover of $9.6 trillion (2025) — up from $7.5 trillion in 2022, according to the Bank for International Settlements (BIS).

Unlike stock exchanges that trade company shares through centralised markets, forex operates over-the-counter (OTC) — meaning transactions occur directly between participants via digital networks.

This structure allows continuous operation 24 hours a day, five days a week, following the global trading day from Sydney → Tokyo → London → New York.

Example

If you buy EUR/USD at 1.0500 and later sell at 1.0600, the euro has strengthened against the dollar by 100 pips, giving you a profit if you predicted the move correctly.

Key Features of the Forex Market

- Decentralised Structure: No single exchange controls trading; prices arise from global supply and demand.

- High Liquidity: Major currency pairs can be bought or sold instantly, even in large volumes.

- Leverage: Traders can control larger positions with smaller deposits, amplifying both gains and losses.

- 24/5 Accessibility: The market never sleeps between Monday and Friday, offering flexibility across time zones.

- Currency Pairs Focus: Every trade involves one currency strengthening while another weakens.

How the Forex Market Works

The forex market operates as a decentralised, over-the-counter (OTC) network that connects banks, financial institutions, corporations, hedge funds, and individual traders around the world.

Unlike the stock market, which relies on centralised exchanges like the NYSE or LSE, forex trading happens electronically through liquidity providers and brokers — meaning transactions occur directly between participants.

The Global Trading Sessions

Because forex follows the sun across time zones, trading runs 24 hours a day, five days a week, continuously rotating through four major financial centres.

This global cycle ensures that the market is always open somewhere in the world.

| Trading Session | UTC Time | South Africa (SAST) | Most Active Pairs |

|---|---|---|---|

| Sydney | 22:00–07:00 | 00:00–09:00 | AUD, NZD pairs |

| Tokyo | 00:00–09:00 | 02:00–11:00 | JPY pairs |

| London | 08:00–17:00 | 10:00–19:00 | EUR, GBP pairs |

| New York | 13:00–22:00 | 15:00–00:00 | USD pairs |

The London–New York overlap (13:00–17:00 UTC / 15:00–19:00 SAST) is the most liquid period of the trading day, when volumes peak and spreads are tightest.

This high liquidity allows traders to enter and exit positions quickly — one of the main reasons forex remains attractive to both professional and retail traders.

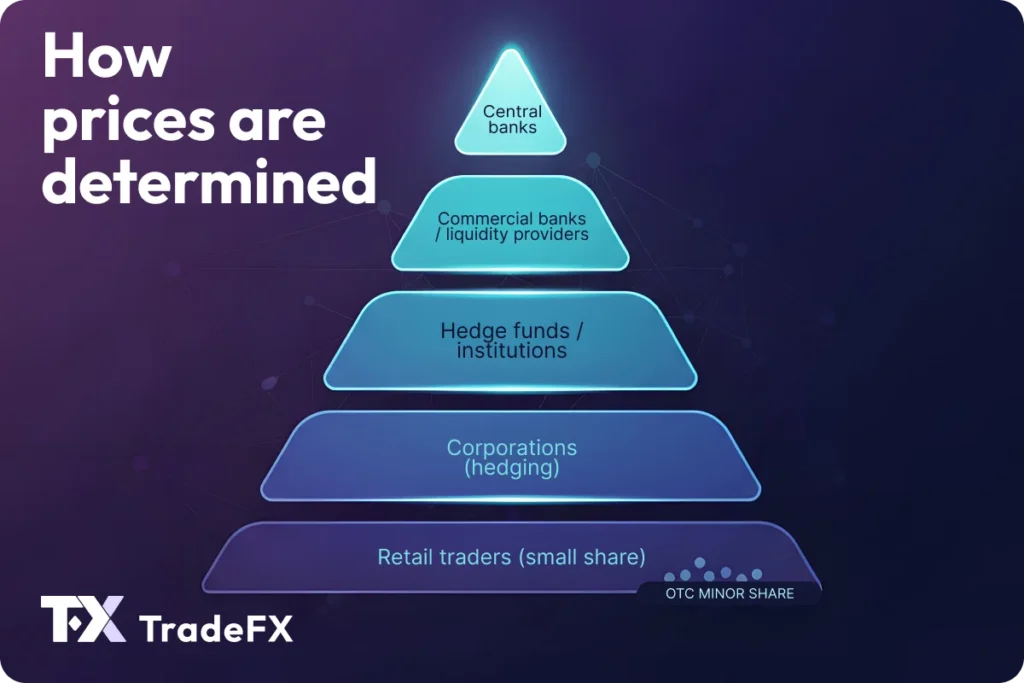

How Prices Are Determined

Currency prices constantly fluctuate due to the interplay of supply and demand, which are shaped by numerous economic and geopolitical factors, including:

- Economic data: GDP growth, inflation, employment figures, and consumer spending.

- Central bank policy: Interest rate decisions and forward guidance.

- Geopolitical events: Elections, conflicts, and trade negotiations.

- Market sentiment: Global risk appetite and investor confidence.

- Trade and capital flows: Imports, exports, and cross-border investment activity.

Large market makers — primarily major banks such as JPMorgan Chase, Citibank, UBS, and Deutsche Bank — continuously quote bid and ask prices for currency pairs.

The difference between these two prices is known as the spread, which represents the transaction cost of trading.

In essence, the forex market functions as a vast, real-time ecosystem where currencies are priced based on how investors, institutions, and governments perceive their relative economic strength at any given moment.

Currency Pairs Explained

Understanding currency pairs is at the heart of forex trading.

Every transaction involves the exchange of one currency for another — meaning currencies are always traded in pairs.

A currency pair shows how much of one currency (the quote currency) is needed to buy one unit of another (the base currency).

Example

EUR/USD = 1.0600

This means 1 euro (EUR) costs 1.06 US dollars (USD).

When you buy EUR/USD, you’re buying euros and selling dollars.

When you sell EUR/USD, you’re selling euros and buying dollars.

Your goal is to profit when the base currency strengthens (or weakens) relative to the quote currency.

Structure of a Currency Pair

- Base currency: The first currency listed (e.g., EUR in EUR/USD).

- Quote currency: The second currency listed (e.g., USD in EUR/USD).

- Exchange rate: The amount of the quote currency required to purchase one unit of the base currency.

Major Currency Pairs

Major pairs always include the US dollar (USD) and are the most liquid and widely traded instruments in the forex market.

These pairs make up around 80–85% of daily global trading volume, according to the latest BIS data.

| Pair | Name | Region/Description |

|---|---|---|

| EUR/USD | Euro vs. US Dollar | Most traded pair globally |

| USD/JPY | US Dollar vs. Japanese Yen | Key Asia–US benchmark |

| GBP/USD | British Pound vs. US Dollar | Known as “Cable” |

| USD/CHF | US Dollar vs. Swiss Franc | Safe-haven pair |

| AUD/USD | Australian Dollar vs. US Dollar | Commodity-linked pair |

| USD/CAD | US Dollar vs. Canadian Dollar | Oil-sensitive pair |

| NZD/USD | New Zealand Dollar vs. US Dollar | Agricultural exporter focus |

Major pairs generally offer tight spreads, high liquidity, and lower volatility, making them ideal for most traders — especially beginners.

Cross Currency Pairs

Cross pairs (or “crosses”) do not include the USD, but they still involve major global currencies.

They’re popular for diversification and hedging strategies.

| Pair | Name |

|---|---|

| EUR/GBP | Euro vs. British Pound |

| EUR/JPY | Euro vs. Japanese Yen |

| GBP/JPY | British Pound vs. Japanese Yen |

| AUD/CAD | Australian Dollar vs. Canadian Dollar |

| EUR/CHF | Euro vs. Swiss Franc |

Crosses tend to have higher volatility and wider spreads than major pairs, reflecting slightly lower liquidity.

Exotic Currency Pairs

Exotic pairs combine a major currency with one from an emerging or smaller economy.

| Pair | Name |

|---|---|

| USD/TRY | US Dollar vs. Turkish Lira |

| EUR/ZAR | Euro vs. South African Rand |

| USD/THB | US Dollar vs. Thai Baht |

| GBP/SGD | British Pound vs. Singapore Dollar |

Exotic pairs can offer strong profit potential but also come with greater volatility, wider spreads, and lower liquidity — making them best suited for experienced traders who understand emerging-market risks.

By understanding how currency pairs work — and which types align with your goals and risk tolerance — you’ll be better prepared to navigate the forex market effectively.

Central Banks

Central banks have a profound impact on currency values through their monetary policies and interventions.

Institutions such as the Federal Reserve (Fed), European Central Bank (ECB), Bank of Japan (BoJ), and Bank of England (BoE) can shift exchange rates significantly when they announce interest rate changes or policy updates.

Key tools used by central banks include:

- Interest rate decisions: Raising rates typically strengthens a currency, while cutting rates tends to weaken it.

- Quantitative easing (QE) or tightening (QT): Adjusting the money supply to influence inflation and economic growth.

- Market intervention: Directly buying or selling currencies to stabilise or influence their value.

- Forward guidance: Signalling future policy intentions to guide market expectations.

Example:

When the Federal Reserve aggressively raised rates between 2022 and 2023 to combat inflation, the US dollar surged against most major currencies — illustrating how central bank policy directly drives currency demand.

Commercial Banks and Financial Institutions

Large commercial and investment banks form the backbone of the forex market.

They act as liquidity providers, facilitating trades for clients and other institutions, while also conducting proprietary trading and risk management.

Their primary roles include:

- Currency conversion: Handling transactions for international businesses and investors.

- Market making: Quoting bid and ask prices for currency pairs, ensuring smooth market function.

- Corporate hedging services: Helping companies manage exchange rate risk.

- Proprietary trading: Engaging in speculative trading to profit from currency movements.

Major players such as JPMorgan Chase, Citi, HSBC, UBS, and Deutsche Bank dominate daily global FX turnover.

Hedge Funds and Investment Firms

Hedge funds, asset managers, and institutional investors participate in forex markets for both speculation and portfolio management.

They manage massive sums of money and often use sophisticated strategies that can move prices when executed at scale.

Common institutional trading strategies include:

- Carry trades: Earning interest rate differentials between currencies.

- Trend following: Riding long-term directional moves in currency pairs.

- Arbitrage: Exploiting price discrepancies across markets or instruments.

- Currency hedging: Protecting international investments from adverse exchange rate movements.

Because of their size, hedge funds can influence short- to medium-term currency trends, especially during volatile market conditions.

Multinational Corporations

Global companies constantly deal with multiple currencies in their operations.

To manage this exposure, they engage in forex markets to hedge risk and stabilise cash flows.

Examples of forex use by corporations include:

- Revenue conversion: Exchanging overseas earnings back to their home currency.

- Supplier payments: Paying international partners in their local currency.

- Investment hedging: Managing foreign asset or subsidiary value fluctuations.

- Forward contracts: Locking in favourable exchange rates for future transactions.

A U.S.-based company expecting €10 million in sales, for instance, may buy a EUR/USD forward contract to protect itself against euro depreciation.

Retail Traders

Retail traders are individual investors who access the forex market through online brokers and trading platforms.

While they represent a smaller share of total volume compared to institutions, their collective participation has grown rapidly thanks to technological innovation and mobile trading apps.

Retail traders typically:

- Speculate on currency price movements for profit.

- Trade with leverage, controlling larger positions with smaller capital.

- Focus on major pairs such as EUR/USD and GBP/USD due to tight spreads and liquidity.

- Use trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), or web-based platforms provided by brokers.

Modern retail traders benefit from instant market access, secure payment methods for deposits and withdrawals, and a wide range of analytical tools once reserved for professionals.

Types of Forex Markets

The foreign exchange market is made up of several interconnected segments, each serving different purposes and time horizons.

Understanding these types of forex markets helps traders and businesses choose the right instruments for their goals, whether that’s short-term speculation or long-term hedging.

Spot Market

The spot market is where currencies are bought and sold at current market prices for near-immediate delivery.

Although the name implies instant settlement, most transactions are completed within two business days (T+2).

Key characteristics of the spot market include:

- Real-time pricing that reflects the latest balance of supply and demand.

- High liquidity, especially in major pairs like EUR/USD and USD/JPY.

- No expiration date — positions can remain open as long as margin requirements are met.

- Direct exposure to price movements without the use of contracts or derivatives.

Most retail forex trading occurs in the spot market through online brokers, making it the entry point for the majority of traders.

Forward Market

The forward market allows two parties to lock in an exchange rate today for a future date.

These contracts are privately negotiated and customisable, making them ideal for companies and institutions seeking to manage currency risk.

Features of forward contracts:

- Customisable amount, currency pair, and settlement date.

- Used primarily for hedging against unfavourable rate movements.

- No upfront premium, unlike options.

- Binding obligation — both parties must settle on the agreed date.

Example:

A South African importer expecting to pay €500,000 in three months can secure today’s EUR/ZAR rate through a forward contract, protecting the company from a stronger euro.

Futures Market

Currency futures are standardised contracts traded on regulated exchanges such as the Chicago Mercantile Exchange (CME).

Each contract specifies the amount, delivery date, and price of the currency to be exchanged.

Advantages of the futures market:

- Transparent pricing published on exchanges.

- Fixed contract sizes and standardised settlement dates.

- Reduced counterparty risk through exchange clearinghouses.

- Useful for traders who prefer regulated environments and predictable terms.

Futures appeal to institutions and professional traders who value oversight, liquidity, and price transparency.

Options Market

The forex options market provides the right — but not the obligation — to buy or sell a currency at a predetermined rate before a specific date.

Options are flexible tools used for both speculation and hedging.

Types of options:

- Call option: The right to buy a currency pair at a set price.

- Put option: The right to sell a currency pair at a set price.

Benefits of trading options:

- Limited risk — the maximum loss is the option premium.

- Strategic flexibility with multiple combinations of calls and puts.

- Ideal for hedging currency exposure while keeping upside potential.

Example:

An exporter expecting future USD revenue might buy EUR/USD call options to protect profits if the dollar weakens.

Swaps Market

Currency swaps involve exchanging currencies now and reversing the exchange at a later date, often at different interest rates.

This market accounts for the largest share of global forex turnover, exceeding the spot market according to the BIS 2025 survey.

Common uses of swaps:

- Short-term funding in foreign currencies.

- Liquidity management for global banks and corporations.

- Interest-rate management by combining currency and yield exposure.

- Central bank operations to support global liquidity.

Swaps are mainly used by financial institutions and central banks to manage funding and interest-rate risks efficiently.

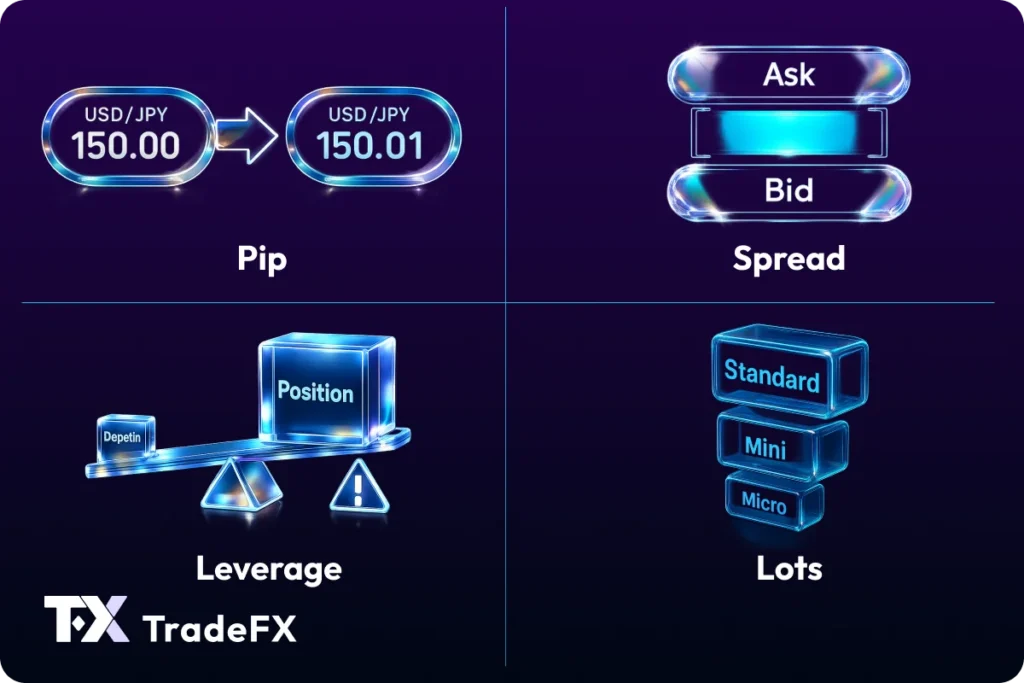

Pip Examples

USD/JPY moves from 150.00 to 150.01 = 1 pip gain.

GBP/USD moves from 1.2750 to 1.2700 = 50 pip loss.

Pip values vary based on position size and the second currency in the pair.

For a standard lot (100,000 units), one pip typically equals $10 in USD-based pairs.

Spread and Transaction Costs

The spread represents the difference between bid (selling) and ask (buying) prices.

Tighter spreads indicate higher liquidity and lower transaction costs.

Typical spreads for major pairs:

- EUR/USD: 0.1–0.3 pips during peak hours.

- GBP/USD: 0.2–0.5 pips.

- USD/JPY: 0.1–0.3 pips.

- Exotic pairs: 2–10+ pips.

Spreads widen during low liquidity periods, major news releases, and market volatility.

Leverage and Margin

Leverage allows traders to control larger positions with smaller capital amounts.

For example, 50:1 leverage means you can control $50,000 in currency with $1,000 in margin.

Leverage examples:

- 10:1 leverage: $1,000 controls a $10,000 position.

- 50:1 leverage: $1,000 controls a $50,000 position.

- 100:1 leverage: $1,000 controls a $100,000 position.

Margin represents the required deposit to open leveraged positions.

Higher leverage requires less margin but amplifies both gains and losses significantly.

Long and Short Positions

In forex trading, you simultaneously buy one currency and sell another:

- Long position: Buying the base currency, expecting it to strengthen.

- Short position: Selling the base currency, expecting it to weaken.

For EUR/USD at 1.0500:

- Going long means buying euros, hoping EUR/USD rises to 1.0600.

- Going short means selling euros, hoping EUR/USD falls to 1.0400.

Position Sizing and Lot Types

Forex positions are measured in lots, with several standard sizes available:

| Lot Type | Units | Pip Value (USD pairs) | Typical Use |

|---|---|---|---|

| Standard | 100,000 | $10 per pip | Institutional/Large accounts |

| Mini | 10,000 | $1 per pip | Small to medium accounts |

| Micro | 1,000 | $0.10 per pip | Beginners/Very small accounts |

| Nano | 100 | $0.01 per pip | Practice/Testing strategies |

Proper position sizing based on account size and risk tolerance is crucial for long-term trading success.

Understanding these core concepts enables you to calculate risks, determine appropriate position sizes, and make informed trading decisions in the dynamic foreign exchange market.

Market Analysis Methods

Successful forex trading depends on analysing the market to identify high-probability opportunities.

Traders use three main approaches — fundamental, technical, and sentiment analysis — often combining them for a complete view of price direction and market strength.

Fundamental Analysis

Fundamental analysis focuses on the economic and political factors that influence currency values.

It helps traders understand long-term trends and anticipate how future events may affect exchange rates.

Key Economic Indicators

- Interest Rate Decisions: Central bank rate changes directly affect a currency’s appeal. When the Federal Reserve raised rates sharply between 2022 and 2023, the U.S. dollar strengthened across major pairs.

- Gross Domestic Product (GDP): Strong GDP growth often supports a currency, while weak growth can lead to depreciation.

- Inflation Data: Rising inflation may lead central banks to tighten policy, boosting the currency’s value.

- Employment Figures: Reports such as the U.S. Non-Farm Payrolls (NFP) can cause sharp short-term volatility.

- Trade Balance: A trade surplus (exports > imports) typically strengthens a nation’s currency.

Geopolitical and Policy Factors

Political events, elections, wars, and international trade agreements can significantly impact currency sentiment.

For example:

- Brexit negotiations led to years of GBP volatility.

- Trade tensions between major economies affect export-orientated currencies.

- Safe-haven demand rises during crises, strengthening currencies like the USD, JPY, and CHF.

Technical Analysis

Technical analysis studies price action on charts to forecast future movements.

This method assumes that all relevant information is reflected in price and that trends tend to repeat over time.

Common Technical Tools

- Moving Averages (MA): Identify trends and dynamic support/resistance zones.

- Relative Strength Index (RSI): Measures momentum and highlights overbought (above 70) or oversold (below 30) conditions.

- MACD (Moving Average Convergence Divergence): MACD shows changes in momentum and potential trend reversals.

- Support and Resistance Levels: Historical price points where buying or selling pressure typically appears.

- Fibonacci Retracement Levels: Help identify potential pullback areas within larger trends.

Chart Timeframes

Different timeframes suit various trading styles:

- 1–15 minute charts: Scalping and intraday trading.

- 1-hour to 4-hour charts: Short-term swing trading.

- Daily charts: Medium-term analysis.

- Weekly/Monthly charts: Long-term position trading.

Sentiment Analysis

Sentiment analysis measures the overall attitude of traders and investors toward a currency or the market as a whole.

It helps identify extreme optimism or pessimism that could lead to reversals.

Key sentiment tools:

- Commitment of Traders (COT) Report: Published weekly by the U.S. CFTC, showing how large speculators and institutions are positioned in futures markets.

- Volatility Indexes (VIX, CVIX): Gauge market fear or complacency, influencing demand for safe-haven currencies.

- Risk Appetite Indicators: Equity markets, bond yields, and commodity prices reflect global confidence or risk aversion.

News Trading

Some traders focus on short-term volatility surrounding major news events.

High-impact announcements include:

- U.S. Non-Farm Payrolls (NFP).

- Federal Reserve, ECB, BoE, or BoJ meetings.

- CPI and inflation releases.

- GDP growth reports.

News traders rely on economic calendars, fast execution, and strict risk management, as price spikes can cause slippage or rapid reversals.

Trading Platforms and Technology

Modern forex trading relies heavily on technology, giving traders around the world direct access to global currency markets.

The right trading platform can make a significant difference in execution speed, analytical capability, and overall trading experience.

MetaTrader Platforms

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) remain the most widely used platforms in the retail forex industry.

They offer advanced charting, algorithmic trading, and mobile access.

Key Features of MT4

- Expert Advisors (EAs): Automate strategies and execute trades without manual input.

- Custom Indicators: Thousands of tools for technical analysis and alerts.

- One-Click Trading: Fast execution for scalpers and active traders.

- Cross-Device Compatibility: Available on desktop, web, and mobile.

Advantages of MT5

- More Timeframes: 21 chart timeframes versus 9 in MT4.

- Integrated Economic Calendar: Tracks key news events in real time.

- Hedging and Netting Options: Flexible trade management for different strategies.

- Expanded Order Types: Additional pending order options and partial close functionality.

MT5 also provides deeper market depth (Level II quotes), making it better suited for advanced traders who require precise order execution.

Web-Based Trading Platforms

Web platforms allow traders to access their accounts directly through a browser, eliminating the need to download software.

These are ideal for traders who prefer simplicity and mobility.

Benefits of web-based platforms:

- No installation required — log in from any device with internet access.

- Always up to date — software updates are automatic.

- Compatible with all operating systems.

- Easy to switch between devices.

Popular options include TradingView, cTrader Web, and proprietary broker platforms offering intuitive interfaces and integrated analysis tools.

Mobile Trading Applications

Smartphones have revolutionised how traders interact with financial markets.

Modern mobile trading apps now offer nearly the same functionality as desktop platforms.

Essential mobile features:

- Live Quotes: Real-time prices for all major currency pairs.

- Charting Tools: Technical indicators, drawing tools, and multiple timeframes.

- Push Notifications: Alerts for price levels, news, and order execution.

- Biometric Login: Fingerprint or face ID security for safer access.

- Offline Charting: Review past analysis without internet connectivity.

Leading mobile apps include MetaTrader Mobile, TradingView Mobile, and custom-built broker apps that synchronize seamlessly with web and desktop platforms.

Institutional Trading Platforms

Professional traders and large institutions use advanced platforms designed for high-volume trading and institutional-grade analytics.

- Bloomberg Terminal: Provides real-time data, charting, news feeds, and direct access to liquidity providers across multiple asset classes.

- Refinitiv (formerly Reuters Dealing): Offers institutional-level execution tools, price aggregation, and risk management capabilities.

These platforms are costly but provide unparalleled access, execution speed, and analytical depth for professional traders and financial firms.

Copy Trading and Social Platforms

Social trading allows beginners to follow and automatically replicate trades from experienced professionals.

- eToro: Pioneered social trading with its CopyTrader system, enabling users to mirror strategies of top-performing traders.

- ZuluTrade: Connects traders with signal providers and offers customisable risk parameters.

- MetaTrader Signals: Built-in copy trading service integrated into MT4 and MT5 platforms.

These platforms combine community insights, transparency, and performance tracking, making forex trading more accessible to new participants.

Algorithmic and API Trading

Algorithmic trading uses pre-programmed rules to open and close trades automatically.

It removes emotion from decision-making and allows continuous market participation.

Key advantages of algorithmic trading:

- Executes trades faster than human reaction time.

- Backtests strategies using historical data.

- Reduces emotional trading errors.

- Operates 24/5 without interruption.

Professional traders also use API trading for direct integration between trading systems and liquidity providers, allowing custom-built strategies and high-frequency trading capabilities.

Risk Management in Forex Trading

Effective risk management is the foundation of long-term success in forex trading.

The use of leverage, market volatility, and psychological pressure can all amplify risk, so traders must apply strict money management principles to protect their capital.

Position Sizing Fundamentals

Proper position sizing ensures that each trade risks only a small percentage of your account balance — typically 1–2% per trade.

This approach protects you from large drawdowns and allows you to survive inevitable losing streaks.

Example:

- Account size: $10,000

- Risk per trade: 2% = $200

- Stop-loss: 50 pips

- Pip value: $200 ÷ 50 = $4 per pip = 0.4 lots (40,000 units)

This calculation keeps risk consistent and prevents emotional decision-making.

Stop-Loss Orders

A stop-loss order automatically closes your position when the market moves against you by a predetermined amount.

It prevents small losses from turning into catastrophic ones.

Types of stop-loss orders:

- Fixed Stop-Loss: Set at a specific distance from entry (e.g., 50 pips).

- Percentage Stop-Loss: Based on a percentage of account equity.

- Technical Stop-Loss: Placed beyond key support or resistance levels.

- Trailing Stop-Loss: Moves with the market to protect profits as the trade progresses.

Example:

Buying EUR/USD at 1.0500 with a 50-pip stop means your trade will close automatically if the price falls to 1.0450.

Take-Profit Orders

A take-profit order secures gains automatically when the market reaches your desired target price.

It locks in profits without requiring constant monitoring.

Effective take-profit techniques:

- Use a risk-to-reward ratio of at least 1:2 (risk $100 to make $200).

- Set targets near key resistance or Fibonacci extension levels.

- Consider partial profit-taking to lock in gains while keeping part of the position open for extended moves.

Leverage Management

Leverage magnifies both profits and losses.

Traders should use it conservatively, especially when learning.

Recommended leverage use:

- Beginners: up to 10:1.

- Intermediate traders: 20:1–50:1 with proven discipline.

- Experienced traders: higher leverage only with tested strategies.

Example:

A 2% adverse price move at 50:1 leverage can wipe out 100% of your account, showing how critical leverage control is.

Diversification

Avoid concentrating all your exposure in one currency pair or correlated markets.

Diversification helps reduce risk and smooth out performance over time.

Ways to diversify:

- Trade multiple currency pairs (e.g., EUR/USD, AUD/JPY, USD/CAD).

- Combine short-term and long-term strategies.

- Avoid overlapping trades in correlated pairs like EUR/USD and GBP/USD.

Risk-Reward Ratios

The risk-reward ratio compares your potential gain to your potential loss.

A 2:1 ratio means you aim to make twice as much as you risk.

Example:

- Entry: EUR/USD at 1.0500

- Stop-loss: 1.0450 (50 pips risk)

- Take-profit: 1.0600 (100 pips reward)

Even if you win only 40% of your trades, a consistent 2:1 risk-reward ratio can still make you profitable.

Trading Psychology and Emotional Control

Emotions often sabotage trading performance more than poor analysis.

Common mistakes include revenge trading, FOMO (fear of missing out), and overconfidence after winning streaks.

Tips for emotional control:

- Accept losses as part of trading.

- Stick to your trading plan — don’t chase losses.

- Use smaller lot sizes during periods of uncertainty.

- Review your trades regularly to identify emotional triggers.

Account Protection Practices

Safeguard your capital with clear limits and structure:

- Set daily and weekly loss caps (e.g., stop trading if down 5% in a week).

- Separate trading funds from personal savings.

- Review performance monthly to refine your approach.

- Practise new strategies on demo accounts before using real money.

Risk management is what separates professional traders from amateurs.

Your first goal in forex trading should not be to make money — but to protect the money you already have.

Advantages and Disadvantages of Forex Trading

Before entering the forex market, it’s important to understand both its benefits and potential downsides.

The foreign exchange market offers flexibility, liquidity, and global access — but it also carries risks that require discipline and education to manage effectively.

Advantages of Forex Trading

24/5 Market Access

The forex market operates 24 hours a day, five days a week, across major financial centres.

Traders can participate at any time — whether during the Asian, European, or American sessions — making forex one of the most flexible markets in the world.

High Liquidity

With an estimated $9.6 trillion in daily trading volume (BIS 2025), forex is the most liquid financial market globally.

This high liquidity allows instant order execution, tight spreads, and efficient pricing even during volatile periods.

Low Transaction Costs

Forex trading typically involves low trading costs, as most brokers charge no commissions on standard accounts.

Your primary cost is the spread, which can be fractions of a pip on major pairs.

Leverage Opportunities

Leverage lets traders control larger positions with less capital.

When used responsibly, it can amplify returns.

For example, 30:1 leverage allows control of $30,000 with just $1,000 in margin.

Profit in Rising or Falling Markets

Forex traders can profit in both directions — buying (going long) when expecting a currency to strengthen or selling (going short) when anticipating weakness.

This flexibility makes forex attractive in any market condition.

Global Market Exposure

Forex trading offers direct exposure to global economies, interest rate cycles, and geopolitical developments — all through a single trading account.

Accessibility and Transparency

Modern brokers provide real-time quotes, secure payment methods, and regulated platforms.

With demo accounts and educational resources, anyone can learn and practise safely before investing real capital.

Disadvantages and Risks of Forex Trading

Leverage Amplifies Losses

While leverage can magnify profits, it also increases potential losses.

A small adverse move can quickly erode an account if risk management is ignored.

Steep Learning Curve

Forex requires a solid understanding of macroeconomics, technical analysis, and emotional control.

Many beginners underestimate how much practice and study are needed to trade successfully.

Market Volatility

Currency prices react sharply to economic data, central bank decisions, and political events.

Volatility offers opportunity but also heightens the risk of slippage and margin calls.

Psychological Pressure

The constant market availability can lead to stress and overtrading.

Emotional reactions — fear, greed, or revenge trading — often cause more losses than poor analysis.

Regulatory Differences

Forex is regulated differently around the world.

Traders in regions like the U.S., U.K., and EU benefit from strong protections, while offshore brokers may offer higher leverage but fewer safeguards.

Counterparty and Technical Risk

Online trading involves reliance on brokers and technology.

System outages, price delays, or insolvency can pose financial risk — choosing a reputable, regulated broker helps minimise this.

Forex vs. Stock Markets

- No Overnight Gaps: Forex trades continuously from Monday to Friday, reducing price gaps common in stocks.

- Currency Pairs vs. Companies: Forex involves relative value between two economies, not individual corporations.

- Economic Focus: Forex trading requires understanding of global macroeconomic trends rather than company earnings reports.

Forex vs. Commodity Markets

- Physical Delivery: Most forex trades are cash-settled; no physical delivery is involved.

- No Storage Costs: Unlike commodities, currencies have no carrying or storage costs.

- Weather Independence: Currency values are unaffected by seasonal or weather changes.

Market Accessibility and Barriers

Low Entry Barriers

- Minimum deposits starting from $1–$100, depending on the broker.

- Demo accounts are available for risk-free practice.

- Abundant free educational resources online.

- Mobile trading apps enable global access anytime.

High Success Barriers

- Requires extensive education and experience.

- Emotional discipline is often more critical than strategy.

- Consistent profitability can take years to achieve.

- Market complexity can overwhelm new traders.

The forex market offers exceptional flexibility, liquidity, and opportunity for traders worldwide.

However, these advantages come with risks that demand discipline, patience, and respect for leverage.

Success depends on education, sound risk management, and emotional control. Getting Started with Forex Trading

Beginning your forex trading journey requires careful planning, education, and the right mindset. By taking a structured approach, you can build a strong foundation and avoid common mistakes that new traders often make.

Education and Preparation

Before investing real money, dedicate time to learning how the forex market works.

Understanding market fundamentals and trading mechanics will give you the confidence to make informed decisions.

Core Topics to Study

- How currency pairs and exchange rates work.

- The impact of economic indicators such as GDP, inflation, and employment data.

- Technical analysis, including chart patterns and indicators.

- Risk management and position sizing.

- Trading psychology and emotional discipline.

Reliable Learning Resources

- Broker education centres and webinars.

- Forex books such as Currency Trading for Dummies and Trading in the Zone.

- Online trading courses and tutorials.

- Free demo accounts that simulate live trading conditions.

Choosing a Forex Broker

Selecting a trustworthy broker is one of the most important steps in starting your forex journey.

The right broker ensures fair execution, transparent pricing, and secure handling of your funds.

Key Factors to Consider

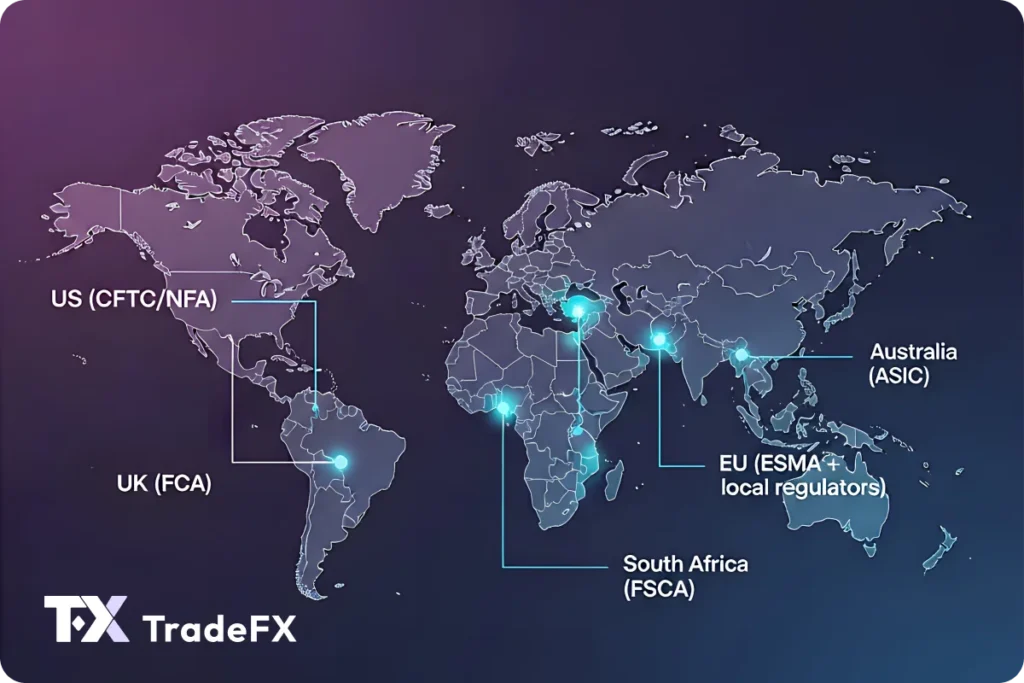

Regulation and Safety

- U.S. traders: Choose brokers regulated by the CFTC and NFA.

- U.K./E.U. traders: Look for regulation from the FCA or CySEC.

- Australian traders: Select brokers licensed by ASIC.

- Avoid unregulated offshore brokers that offer high leverage but limited protection.

Trading Costs

- Compare spreads and commissions for major pairs like EUR/USD.

- Review overnight swap rates for positions held beyond daily rollover.

- Check for deposit or withdrawal fees that could impact your profits.

Platform and Tools

- Choose brokers that support MetaTrader 4, MetaTrader 5, or TradingView.

- Look for advanced charting, fast execution, and mobile compatibility.

- Use brokers offering integrated economic calendars and real-time market news.

Customer Support

- 24/5 multilingual customer service.

- Multiple contact methods such as live chat, phone, and email.

- Quick and professional responses to trading or technical issues.

Secure Payment Methods

Ensure your broker provides secure, verified payment options for deposits and withdrawals — such as bank transfers, major debit/credit cards, or trusted e-wallets — with transparent processing times and clear fee structures.

Account Types and Minimum Capital

Forex brokers offer different account types to suit varying experience levels and budgets.

| Account Type | Minimum Deposit | Typical Lot Size | Best For |

|---|---|---|---|

| Demo | $0 | Any | Practice and learning |

| Micro | $1–$100 | 1,000 units | Beginners |

| Mini | $100–$500 | 10,000 units | Small accounts |

| Standard | $1,000+ | 100,000 units | Experienced traders |

Recommended Starting Capital

- Minimum: $500–$1,000 to trade responsibly.

- Ideal: $2,000–$5,000 for balanced position sizing and flexibility.

- Always trade with money you can afford to lose.

Developing a Trading Plan

A trading plan defines your goals, strategy, and risk parameters.

It helps remove emotion from decision-making and ensures consistent behaviour in different market conditions.

Your trading plan should include:

- Goals: Define realistic profit targets (e.g., 10–20% per year for beginners).

- Strategy: Choose pairs, timeframes, and setups you understand.

- Entry and Exit Rules: Decide in advance when to open or close trades.

- Risk Management: Limit exposure per trade to 1–2% of your account.

- Review Process: Keep a detailed trading journal to track progress and identify areas for improvement.

Practicing on a Demo Account

Before going live, practise on a demo account that replicates real market conditions without financial risk.

Tips for demo trading:

- Treat it like a real account with realistic trade sizes.

- Follow your trading plan and apply risk management.

- Track your trades and analyse results.

- Stay on demo until you’ve achieved consistent profitability.

Transitioning to Live Trading

When moving from demo to live trading:

- Start small, using micro or mini lots.

- Keep leverage low and risk minimal.

- Focus on execution discipline and emotional control.

- Increase position size gradually as confidence and performance improve.

Forex trading success comes from patience, preparation, and consistency.

By educating yourself, choosing a reputable broker, and developing a disciplined approach, you’ll be equipped to navigate the markets responsibly and confidently.

Starting Small and Building Skills

When transitioning from demo to live trading, it’s best to begin with the smallest possible positions to adapt to the emotional and psychological realities of risking real money.

Even a well-tested strategy can feel different once real funds are on the line.

Gradual scaling approach:

- Start with micro lots: Trade small positions (1,000 units) to limit exposure and control risk.

- Increase size slowly: Only raise your position size after achieving consistent profitability over time.

- Focus on process, not profits: Concentrate on following your trading plan accurately rather than chasing returns.

- Accept the learning curve: Early mistakes and small losses are part of building real-world experience.

Success in forex trading comes from patience, education, and disciplined execution.

Take time to prepare properly, choose reputable brokers, and develop robust strategies before aiming for significant profits.

The forex market will always be there — focus on long-term skill development rather than quick gains.

Common Trading Strategies

Successful forex traders use a variety of strategies based on time commitment, risk tolerance, and market conditions.

Understanding these different approaches will help you find a trading style that fits your goals and lifestyle.

Scalping

Scalping is a fast-paced trading style focused on capturing very small price movements, often just a few pips at a time.

Trades typically last from seconds to a few minutes.

Key characteristics:

- Holding time: 1–5 minutes per trade.

- Profit target: 3–10 pips per trade.

- Trade frequency: Dozens or even hundreds of trades per day.

- Requires ultra-tight spreads and rapid execution.

Common scalping methods:

- Trading during high-liquidity sessions (London–New York overlap).

- Using one-click execution and low-latency platforms.

- Applying high-probability indicators such as moving averages or stochastic oscillators.

Scalping demands concentration, discipline, and lightning-fast decision-making.

It is best suited for experienced traders with time to monitor charts constantly.

Day Trading

Day trading involves opening and closing all positions within the same trading day to avoid overnight risk.

Traders aim to capture intraday price swings and rely on technical setups for entries and exits.

Characteristics:

- Holding time: 30 minutes to 8 hours.

- Profit targets: 10–50 pips per trade.

- Chart timeframes: 5-minute to 1-hour charts.

Popular day trading approaches:

- Breakout trading: Entering when price breaks key support or resistance levels.

- Reversal trading: Identifying exhaustion points after strong moves.

- News trading: Taking advantage of volatility following economic releases.

Day traders benefit from frequent opportunities and predictable schedules but must manage stress and avoid overtrading.

Swing Trading

Swing trading targets larger price moves over several days or weeks.

It’s ideal for traders who cannot monitor the market all day but still want to capture meaningful price swings.

Typical features:

- Holding time: 2 days to 3 weeks.

- Profit targets: 50–300 pips per trade.

- Chart timeframes: 4-hour and daily charts.

Common swing strategies:

- Trading pullbacks within established trends.

- Using chart patterns like flags, triangles, or head-and-shoulders formations.

- Combining fundamental and technical analysis to confirm trade direction.

Swing trading allows more flexibility and can deliver higher risk-reward ratios with less screen time than day trading.

Position Trading

Position trading is a long-term strategy that involves holding trades for weeks, months, or even years.

It focuses on macroeconomic trends and major shifts in monetary policy.

Core characteristics:

- Holding time: 1 month to 1+ year.

- Profit targets: 200–1,000+ pips per trade.

- Chart timeframes: Daily, weekly, or monthly charts.

Position trading examples:

- Buying currencies with rising interest rates and selling those with falling rates.

- Holding trades through extended economic cycles or central bank policy changes.

Because positions are held for long durations, this strategy requires patience, strong fundamental analysis, and sufficient margin to handle market fluctuations.

Carry Trading

Carry trading involves borrowing (selling) a currency with a low interest rate and buying one with a higher interest rate to profit from the interest rate differential.

Example:

Buying AUD/JPY when Australia offers higher interest rates than Japan allows you to earn daily interest payments (positive swap).

Risks and considerations:

- If the high-yield currency weakens, exchange rate losses can outweigh the interest gained.

- Carry trades perform best during stable, risk-on market conditions.

Carry trading is popular among institutional traders and long-term investors seeking yield in addition to price movement.

News Trading

News trading focuses on volatility generated by major economic events such as central bank meetings, inflation data, or employment reports.

Common high-impact events:

- U.S. Non-Farm Payrolls (NFP).

- Federal Reserve and European Central Bank interest rate decisions.

- GDP and inflation (CPI) releases.

- Geopolitical developments and elections.

Approaches to news trading:

- Breakout strategy: Entering trades immediately after data release when volatility spikes.

- Straddle strategy: Placing buy and sell orders on both sides of the current price before the announcement.

- Fade strategy: Waiting for initial spikes to settle and then trading against overreactions.

News trading offers high reward potential but carries significant risk due to slippage and unpredictable price swings.

Strict risk management is essential.

Regulatory Environment

The forex market operates under different regulatory frameworks worldwide.

Regulation ensures transparency, protects traders from fraud, and maintains stability across global financial systems.

Understanding how each region oversees forex trading helps you choose a safe, compliant, and trustworthy broker.

United States Regulation

The United States maintains one of the most tightly regulated forex environments, prioritising trader protection and market integrity.

Main Regulatory Bodies

- Commodity Futures Trading Commission (CFTC): Oversees forex derivatives and enforces financial standards.

- National Futures Association (NFA): Audits brokers, monitors conduct, and ensures client fund safety.

- Federal Reserve: Sets monetary policy influencing the USD and overall liquidity.

Key U.S. Rules

- Leverage limits: 50:1 for major pairs, 20:1 for minors.

- FIFO rule: The earliest opened position must be closed first.

- No hedging: Traders can’t hold long and short positions in the same pair.

- Client fund segregation: Brokers must keep client deposits separate from operational funds.

- Mandatory registration: All U.S.-facing brokers must register with both the CFTC and NFA.

European Union Regulation

The European Securities and Markets Authority (ESMA) harmonises forex regulation across EU countries to ensure consistent trader protection and financial transparency.

ESMA Standards

- Leverage limits: 30:1 for majors, 20:1 for minors, lower for exotics.

- Automatic margin close-out: Positions close if margin falls below 50%.

- Negative balance protection: Traders cannot lose more than their deposit.

- Marketing restrictions: Bans misleading bonus promotions.

- Risk disclosures: Brokers must display the percentage of losing retail accounts.

Key National Regulators

- CySEC: Cyprus Securities and Exchange Commission.

- BaFin: Germany’s Federal Financial Supervisory Authority.

- AMF: France’s Autorité des Marchés Financiers.

- CNMV: Spain’s Comisión Nacional del Mercado de Valores.

United Kingdom Regulation

After Brexit, the United Kingdom maintains an independent but equally strict regulatory framework through the Financial Conduct Authority (FCA).

FCA Requirements

- Leverage cap: 30:1 for major pairs.

- Client protection: Segregated accounts and detailed audit requirements.

- FSCS compensation: Up to £85,000 coverage per client under the Financial Services Compensation Scheme.

- Strict marketing rules: Transparency and fairness in broker communications.

The FCA remains one of the most respected regulators worldwide, ensuring strong consumer protection and operational integrity.

Australian Regulation

The Australian Securities and Investments Commission (ASIC) supervises forex brokers through a structured licensing system to protect traders and maintain market confidence.

ASIC Regulations

- Brokers must hold an Australian Financial Services (AFS) licence.

- Leverage limits: 30:1 for majors, 20:1 for minors, and 10:1 for commodities.

- Capital requirements: Minimum financial reserves for all licensed brokers.

- Client dispute resolution: Access to the Australian Financial Complaints Authority (AFCA).

- Risk disclosures: Clear communication of leverage risks and costs.

Australia’s framework balances flexibility with protection, making it a preferred base for many top-tier brokers.

South Africa Regulation

In South Africa, forex trading is regulated by the Financial Sector Conduct Authority (FSCA), formerly known as the FSB.

The FSCA ensures brokers operate fairly and transparently, protecting retail traders from financial misconduct.

FSCA Regulatory Standards

- Licensing: Brokers offering forex trading to South African residents must be authorised by the FSCA.

- Segregated accounts: Client funds must be kept separate from broker operational funds.

- Transparency: Brokers must disclose fees, leverage limits, and risk policies clearly.

- Dispute resolution: Clients can lodge complaints through the FSCA’s official consumer protection channels.

- Local representation: FSCA-licensed brokers must maintain a physical presence or authorised office within South Africa.

Why FSCA Regulation Matters

- Ensures compliance with South African financial laws.

- Provides legal protection under the Financial Advisory and Intermediary Services (FAIS) Act.

- Enhances trust and credibility, especially for brokers marketing to South African clients.

Well-known international brokers such as Exness, XM, and Tickmill operate under FSCA authorisation to offer locally compliant forex trading services.

Offshore and Unregulated Brokers

Some traders are tempted by offshore brokers offering high leverage and low restrictions.

However, these options come with elevated risk.

Common Offshore Jurisdictions

- Seychelles (FSA)

- Vanuatu (VFSC)

- St. Vincent and the Grenadines (SVGFSA)

- Marshall Islands

Risks

- Weak oversight and minimal capital requirements.

- No compensation schemes if the broker fails.

- Limited transparency and poor legal recourse.

- Withdrawal and execution issues.

South African traders should always verify a broker’s FSCA licence number on the regulator’s official website to confirm legitimacy before depositing funds.

How to Verify Broker Regulation

Steps to Confirm a Broker’s Legitimacy

- Check the broker’s registration number on their website.

- Verify it through the regulator’s official database (CFTC, FCA, CySEC, ASIC, or FSCA).

- Read the broker’s client agreement for fund protection clauses.

- Avoid companies that operate solely under offshore licences.

Red Flags to Avoid

- Unrealistic leverage (e.g., 1000:1 or more).

- Guaranteed profit claims or “risk-free” trading offers.

- Difficulties withdrawing funds.

- Missing or unverifiable registration details.

A properly regulated broker offers transparency, secure fund management, and access to legal recourse — key elements for safe and confident forex trading.

Market Psychology and Trader Mindset

Achieving success in forex trading requires more than technical knowledge and strategy — it demands psychological discipline, emotional control, and patience.

The ability to manage your mindset often determines whether you succeed or fail in the long run.

Emotional Control in Trading

Forex trading constantly tests your emotions.

Price fluctuations, unexpected news, and rapid gains or losses can lead to impulsive decisions.

Controlling emotions such as fear and greed is essential to consistent performance.

Common emotional challenges:

- Fear and Greed: Fear stops traders from taking good opportunities, while greed pushes them to overtrade or ignore stop-losses.

- Fear of Missing Out (FOMO): Jumping into trades too late after seeing rapid price movement.

- Revenge Trading: Increasing position sizes after a loss to recover quickly—often leading to even bigger losses.

- Analysis Paralysis: Overanalysing every detail and missing clear setups.

- Overconfidence: Winning streaks can cause traders to ignore risk management rules.

The key is to follow your plan, not your emotions.

Every trade should be based on logic and strategy, not impulse.

Building Trading Discipline

Discipline means doing the right thing even when emotions tempt you to act otherwise.

A disciplined trader follows a trading plan consistently and doesn’t deviate under pressure.

Ways to develop discipline:

- Create and follow a trading plan: Define entry, exit, and risk criteria before trading.

- Set stop-losses for every trade: Never remove or widen them once the trade is open.

- Maintain consistent position sizing: Don’t increase trade size based on “gut feeling.”

- Stick to trading hours: Trade at the same times daily to maintain structure.

- Use a trading journal: Record trades, emotions, and outcomes to identify habits and mistakes.

Discipline transforms a trader from reactive to systematic, ensuring consistency even in unpredictable markets.

Managing Expectations

Many beginners enter forex expecting fast profits, but sustainable success takes time.

Managing expectations helps prevent emotional burnout and frustration.

Realistic trading expectations:

- Learning consistent profitability takes 1–3 years of study and practice.

- Professional traders often aim for 10–30% annual returns, not overnight riches.

- Winning only 50–60% of trades can still yield profit if losses are smaller than wins.

- Drawdowns and losing streaks are normal — even the best traders experience them.

Patience and realistic goals build emotional resilience and prevent reckless trading behaviour.

Developing Patience and Timing

Successful forex traders understand that not trading is sometimes the best trade.

Patience helps filter out low-quality setups and wait for high-probability opportunities.

Practical patience tips:

- Focus on quality over quantity — take only trades that meet all your criteria.

- Wait for confirmation signals before entering a position.

- Avoid chasing trades after missing an entry; wait for the next setup.

- Use alerts or automated tools to reduce the urge to constantly monitor charts.

- Hold winning trades longer instead of taking small profits too early.

Patience ensures consistency, while impulsiveness leads to inconsistent results.

Continuous Learning and Improvement

Forex markets evolve constantly due to global events, technology, and changing liquidity conditions.

Continuous learning keeps you adaptable and competitive.

Ways to keep improving:

- Study professional traders: Learn from their experiences and interviews.

- Review your trading performance regularly: Identify strengths and correct weaknesses.

- Stay updated: Follow economic calendars, central bank news, and market trends.

- Test strategies on demo accounts: Refine new approaches before using real capital.

- Engage with trading communities: Exchange insights and learn from peers.

Growth in trading comes from learning, adapting, and applying new knowledge over time.

Managing Stress and Maintaining Balance

Forex trading can be mentally demanding.

Managing stress ensures better focus and prevents emotional decision-making.

Healthy trading habits:

- Exercise regularly to reduce stress and improve concentration.

- Get sufficient sleep — fatigue leads to impulsive mistakes.

- Practise mindfulness or meditation to stay calm under pressure.

- Maintain work-life balance; step away from screens when overwhelmed.

- Separate trading funds from personal finances to reduce anxiety.

Trading should enhance your lifestyle, not dominate it.

Maintaining balance helps you stay objective and emotionally stable.

Success in forex trading depends as much on your mindset and emotional control as on technical skills.

Developing discipline, patience, and resilience will help you navigate challenges and sustain long-term profitability.

Building a Sustainable Forex Trading Journey

The foreign exchange market offers immense opportunity — but also demands respect, patience, and preparation.

For South African traders, forex represents a gateway to global financial participation, supported by FSCA regulation, local broker options, and accessible technology.

Yet success doesn’t come from quick wins or luck; it comes from education, strategy, and discipline.

Forex trading should be viewed as a long-term skill, not a shortcut to wealth.

The traders who thrive are those who take time to:

- Master the fundamentals — understanding how currency pairs, leverage, and risk truly work.

- Develop a strategy that fits their lifestyle, risk tolerance, and financial goals.

- Apply strict risk management — protecting capital before chasing profits.

- Maintain emotional control — staying calm through losses and patient through wins.

In today’s evolving market, South African traders have access to world-class brokers, secure payment systems, and real-time market data that were once limited to institutions.

Whether you’re trading from Johannesburg, Cape Town, or Durban, the key advantage lies not in the platform you use — but in how consistently you apply what you’ve learnt.

Forex trading isn’t about predicting every market move — it’s about managing risk, thinking strategically, and growing steadily.

With the right mindset, preparation, and guidance, your journey in the forex market can evolve from curiosity to confidence and, ultimately, to consistent, disciplined success.