Are you interested in learning more about GER30/GER40 trading hours in South Africa SAST (GMT+2) time zone?

The Deutsche Aktienindex (DAX) was formerly known as GER30 or DAX 30 (legacy name).

Many analysts see it as a yardstick for measuring Germany’s economy.

The GER30 acted as the stock index, which the FSE introduced in 1988, with a reference price set at 1000 in 1987.

We will continue to refer to the GER40 by its legacy name, the GER30 Index, which is the most commonly used term by traders in South Africa.

What time does GER30 open in South Africa?

The Frankfurt Stock Exchange market’s opening and closing trading hours are 9:00 a.m. to 17:30 p.m. SAST (GMT+2) during the summer (CEST) and 10:00 a.m. to 18:30 p.m. SAST (GMT+2) during the winter (CET).

The Frankfurt Stock Exchange market opening time in South Africa by its legacy name, viz., GER30 or German30.

What time does GER40 open in South Africa?

The Frankfurt Stock Exchange market’s opening and closing trading hours are 9:00 a.m. to 17:30 p.m. SAST (GMT+2) during the summer (CEST) and 10:00 a.m. to 18:30 p.m. SAST (GMT+2) during the winter (CET).

The Frankfurt Stock Exchange market opening time in South Africa by its official (since September 2021) name, viz., GER40 or German40.

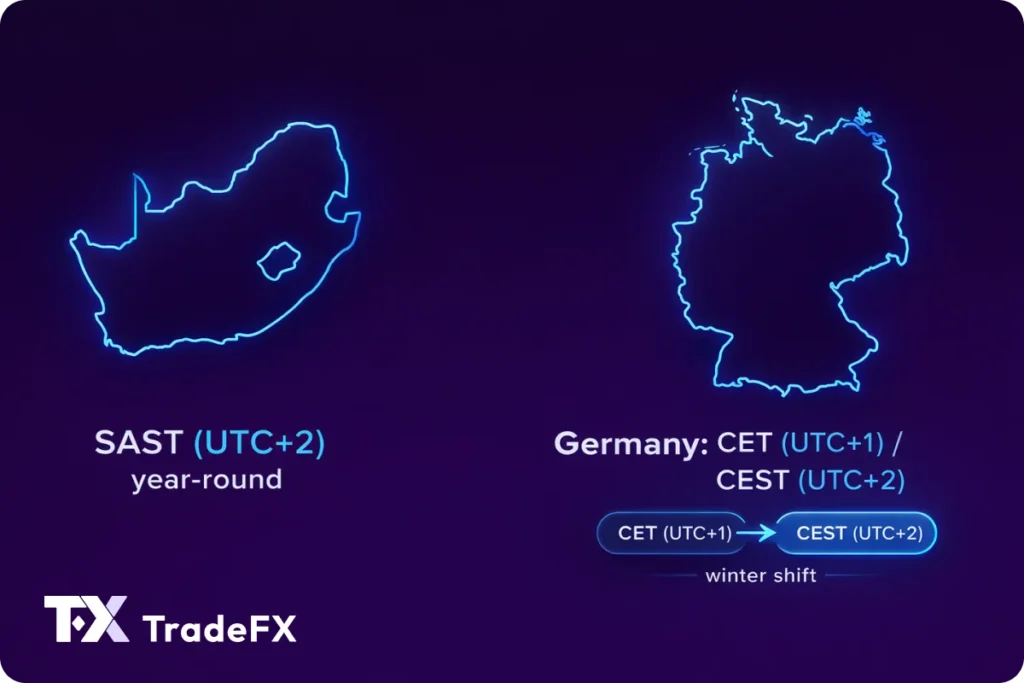

South Africa stays on SAST = UTC/GMT +2 year-round (no DST), while Germany switches between CET and CEST.

| Frankfurt Stock Exchange (Xetra) Trading Hours In South Africa Time (SAST, UTC+2) | |||

|---|---|---|---|

| Season | Germany Time Zone | Open (SAST) | Close (SAST) |

| Summer | CEST (UTC+2) | 09:00 | 17:30 |

| Winter | CET (UTC+1) | 10:00 | 18:30 |

Note: Xetra’s core session is 09:00–17:30 local time in Germany. SAST is UTC+2 year-round.

Many traders tend to forget to take Daylight Saving Time (learn more about DST) into account, which can easily throw off their market open trading strategy.

These are the hours when the underlying German stocks are active on the Frankfurt Stock Exchange.

Look at the table below indicating GER30 trading hours in GMT during winter and summer (Germany is always 1 hour ahead of the UK).

| Frankfurt Stock Exchange (Xetra) Trading Hours – United Kingdom Time (BST/GMT) | |||

|---|---|---|---|

| Season | Germany Time Zone | Open (BST/GMT) | Close (BST/GMT) |

| Summer | CEST (UTC+2) | 08:00 (BST) | 16:30 (BST) |

| Winter | CET (UTC+1) | 08:00 (GMT) | 16:30 (GMT) |

Note: Xetra’s core session is 09:00–17:30 local time in Germany (switches between CET and CEST). UK time (view London market open time) switches between GMT (winter) and BST (summer).

Also thinking of trading the US30 during the New York market session or the Hang Seng during the Asian market session?

Brokers often extend these times by creating a 24-hour CFD or spread betting market.

They do this with pricing algorithms that simulate movements.

It looks like real trading, but it isn’t.

When the exchange is closed, no shares are actually being bought or sold.

Why does that matter?

Without genuine trading volume, the data you see can be misleading.

Technical tools such as pivot levels, volume indicators, or moving averages may generate signals that don’t reflect true market activity.

Relying on this synthetic data often leads to poor trading decisions and frustration (revenge trading…).

What is the best time to trade GER30 in South Africa?

The truth is, not every day or hour is meant for trading the GER30.

Sometimes the smartest move is to step back and sit on your hands.

The market isn’t going anywhere, and patience is often the edge that separates disciplined traders from impulsive ones (trigger-happy).

The best time to trade GER30 is often within the first 1-2 hours following the market’s opening.

Considered the best hours for trading by many GER30 traders in South Africa are 9:00 a.m. to 11:00 a.m. SAST (GMT+2) during the summer (CEST) and 10:00 a.m. to 12:00 p.m. SAST (GMT+2) during the winter (CET).

Liquidity is high, volatility spikes, and price movements tend to be more predictable.

GER30 traders tend to take advantage of market overlaps due to this very reason: market volatility.

Can you trade the GER 30 on the weekends?

Actually, no!

The official GER30 Index does not trade over weekends.

The Frankfurt Stock Exchange, where the index is based, is completely closed on Saturdays and Sundays.

No official buying or selling of the underlying German stocks takes place during this time.

Note: You can’t trade the GER30 itself over the weekend, even if your friend says so (share this article with them).

What you see with CFDs or futures is extended access provided by CFD and spread betting brokers, not activity on the Frankfurt exchange.

These products usually run from Sunday evening through to Friday night, with a short daily pause.

You might notice prices begin moving again on Sunday evening when global futures markets reopen, but this is not continuous weekend trading.

It’s simply the early start of the next trading week.

Are GER30 and GER40 the same?

Yes, there is no difference between GER30 and GER40 other than the index name change due to an additional 10 companies being added from the original 30.

As of September 2021, there are 40 companies in the DAX portfolio.

Ten new companies were added from the MDAX.

This gave the index more diversification and liquidity.

It also made the DAX a better reflection of the German economy.

The change brought it in line with other major global indices.

Many CFD and spread betting brokers have decided to stick to the well-known legacy name, the GER30, to avoid trader confusion.

What companies does the GER40 index cover in Germany?

companiesmarketcap: 40 DAX company list source

- Adidas AG (ETR: ADS) – Iconic sportwear maker, globally known for its athletic shoes and apparel.

- Airbus SE (ETR: AIR) – Aerospace giant producing commercial and military aircraft, plus space systems.

- Allianz SE (ETR: ALV) – One of the world’s leading insurance and financial services providers.

- BASF SE (ETR: BAS) – Leading chemical company, offering products from plastics to performance materials.

- Bayer AG (ETR: BAYN) – Global pharmaceutical and life sciences firm, recognized for products in health and agriculture.

- Beiersdorf AG (ETR: BEI) – Beauty and personal-care specialist, behind brands like Nivea.

- BMW (Bayerische Motoren Werke) – Luxury automotive manufacturer known for BMW, MINI, and Rolls-Royce models.

- Brenntag SE (ETR: BNR) – Worldwide chemical and ingredient distributor to industries across the globe.

- Commerzbank AG (ETR: CBK) – Major German bank offering retail, corporate, and private banking services.

- Continental AG (ETR: CON) – Automotive parts leader, particularly in tires, brake systems, and vehicle electronics.

- Daimler Truck Holding AG (ETR: DTG) – One of the largest global commercial vehicle manufacturers.

- Deutsche Bank AG (ETR: DBK) – Global banking and financial services firm active across investment and asset management.

- Deutsche Börse AG (ETR: DB1) – Operates financial exchanges and clearing systems, including the DAX index.

- Deutsche Post AG (ETR: DHL) – Global logistics and parcel delivery network (behind DHL).

- Deutsche Telekom AG (ETR: DTE) – Europe’s leading telecom operator with mobile, broadband, and TV services.

- E.ON SE (ETR: EOAN) – Key player in energy supply and utility services across Europe.

- Fresenius SE & Co. KGaA (ETR: FRE) – Healthcare provider delivering products and services for dialysis and hospital care.

- Fresenius Medical Care (ETR: FME) – Specialist in dialysis services and kidney-care products.

- Hannover Rück (Hannover Re) (ETR: HNR1) – One of the world’s largest reinsurance groups.

- Heidelberg Materials AG (ETR: HEI) – Global producer of building materials like cement and aggregates.

- Henkel AG & Co. KGaA (ETR: HEN3) – Consumer goods maker with brands in adhesive technologies and beauty care.

- Infineon Technologies AG (ETR: IFX) – Top semiconductor company powering auto, industrial, and IoT electronics.

- Mercedes-Benz Group AG (ETR: MBG) – Prestige automaker known for its Mercedes-Benz brand.

- Merck KGaA (ETR: MRK) – Innovative chemical and pharmaceutical company with roots going back centuries.

- MTU Aero Engines AG (ETR: MTX) – Developer and manufacturer of aircraft engines and propulsion systems.

- Münchener Rückversicherungs-Gesellschaft (Munich Re) (ETR: MUV2) – One of the leading global reinsurers.

- Porsche Automobil Holding SE (ETR: PAH3) – Holding company with a majority stake in Volkswagen Group.

- Porsche AG (ETR: P911) – High-performance sports-car maker renowned for models like the 911 and Taycan.

- Qiagen NV (ETR: QIA) – Biotechnology firm specializing in sample and assay technologies for labs.

- Rheinmetall AG (ETR: RHM) – Technologies and services provider for defense and automotive sectors.

- RWE AG (ETR: RWE) – Energy provider focused on renewable generation and utility services.

- SAP SE (ETR: SAP) – Global leader in enterprise software, especially ERP systems.

- Sartorius AG (ETR: SRT3) – Laboratory and bioprocess technology company serving the life sciences sector.

- Siemens AG (ETR: SIE) – Industrial powerhouse in automation, digital systems, and infrastructure.

- Siemens Energy AG (ETR: ENR) – Provider of sustainable energy transitions, including power generation solutions.

- Siemens Healthineers AG (ETR: SHL) – Medical technology firm offering imaging, diagnostics, and lab services.

- Symrise AG (ETR: SY1) – Creator of fragrances, flavors, and cosmetic ingredients for diverse industries.

- Volkswagen AG (ETR: VOW3) – Global auto manufacturer producing VW, Audi, Porsche, and other brands.

- Vonovia SE (ETR: VNA) – Germany’s largest residential real estate company.

- Zalando SE (ETR: ZAL) – Leading European online fashion and lifestyle retailer.

These are the 40 DAX companies currently steering the German index and representing a wide swath of sectors.

These companies span a wide range of industries, from automotive and healthcare to tech and logistics.

How can you invest in the DAX index in South Africa?

South Africans who want exposure to the DAX have a few options.

The most direct route is through exchange-traded funds (ETFs) that track the index on European stock exchanges.

These funds mirror the performance of the German market and are accessible through global brokerage accounts.

Some of the biggest names in the DAX, such as Adidas, Siemens and Bayer, also trade as American Depository Receipts (ADRs) in the US.

This makes them easier to buy if your broker offers access to US markets.

Some trade only in Frankfurt, so a global or international account is usually required by default.

If you prefer the ETF route, here are five well-known funds that track the DAX:

- iShares Core DAX UCITS ETF (EXS1)

- X-Trackers DAX UCITS ETF (DBXD)

- ComStage DAX UCITS ETF (C001)

- Lyxor DAX UCITS ETF (LYY7)

- Deka DAX UCITS ETF (EL4A)

For South African investors without offshore accounts, another option is to invest locally in international feeder funds or ETFs offered by JSE-listed providers.

These don’t always track the DAX directly, but they can still give you exposure to developed markets, including Germany.

For South African investors, ETFs are usually the most practical way to gain exposure to the DAX.

Why?

They offer comprehensive market access through a single product.

Alternatives to the DAX 30 index in South Africa

South African investors can also access Germany through broader MSCI Index ETFs, such as the iShares MSCI Germany ETF (NYSE: EWG), along with other funds that include significant exposure to German equities.

It’s worth noting that some South African companies are listed abroad through ADRs on US stock exchanges.

While these are not part of the DAX, they can still provide indirect exposure and form part of a diversified offshore portfolio.

For those looking at regional exposure, here are a few popular ETFs that include Germany as part of a wider European focus:

- Vanguard FTSE Europe ETF (NYSE: VGK)

- SPDR DJ Euro Stoxx 50 ETF (NYSE: FEZ)

- iShares MSCI Eurozone ETF (NYSE: EZU)

When evaluating these options, South African investors should pay attention to how the funds are weighted, their management fees, and total expense ratios.

Costs and exposure levels can vary, so it’s important to ensure the ETF fits your overall offshore investment strategy.

Why Trade the GER30 Index?

With so many global markets available, it’s fair to ask why the DAX deserves your attention.

If you’ve watched the GER30 for as long as I have, you’ll know it has its own rhythm, personality and nuances.

The GER30 index attracts traders for five compelling reasons:

Highly technical by nature

Technical analysis can exploit the predictable price patterns that the DAX often repeats.

It fits well with many strategies, from scalping to swing trading and breakout setups. Because it responds cleanly to chart structures, it gives traders the confidence to act with discipline.

Volatility in the right balance

This index has a high value and generally delivers healthy volatility.

It moves enough to create opportunities but not so wildly that it becomes impossible to trade.

Of course, some sessions can still be sharp and fast, but overall, the DAX is consistent and highly liquid.

This is precisely what day traders look for.

Less prone to black swan shocks

While a single stock can collapse overnight, the design of indices ensures diversification.

Even if one company suffers a surprise event, the impact is cushioned by the other 39.

This strategy doesn’t remove all risk, but it does reduce the chance of extreme, unpredictable moves compared with currencies or commodities.

Clear support and resistance levels

The DAX has a habit of respecting technical zones.

Traders often use strong support and resistance levels for entries, exits, stop losses, and profit targets.

This property makes it a favourite for traders who rely on price action.

Potential for longer swings

Unlike forex or commodities, indices reflect real businesses.

The goal of these companies is growth and profit.

When they succeed, the index rises over time.

This creates opportunities not only for short-term trades but also for longer swing positions aligned with the broader trend.

They want to value their assets, and they want to be able to get a dividend.

This type of investment differs from forex, commodities, and other asset classes.

What This Means for Investors

For South African and international investors, there are several ways to gain DAX exposure.

Some DAX companies trade as American Depository Receipts (ADRs), making them accessible through US markets.

Broader exposure can be achieved through ETFs that track the DAX or via international brokerage accounts that provide direct access to the Frankfurt Stock Exchange.

For South African investors, exposure is usually obtained through:

- Offshore brokerage accounts

- Feeder funds

- International ETFs

These options make it possible to diversify into Europe’s strongest blue-chip index without needing to buy each component individually.

In essence, the GER30 offers a window into the strength and resilience of German industry.

For long-term investors, it provides diversification and stability.

For traders, it offers liquidity, volatility, and technical clarity.

In both cases, it remains one of the most important indices in global finance.

Key Takeaways: GER30 (GER40) Trading Hours in South Africa

- GER30 vs GER40: The GER30 is the legacy name of the DAX index, which now includes 40 major German companies (GER40) since 2021.

- Market Hours (SAST):Frankfurt Stock Exchange (Xetra) opens 09:00–17:30 in summer (CEST) and 10:00–18:30 in winter (CET).

- Time Zone Difference: South Africa stays on SAST (UTC+2) year-round, while Germany switches between CET and CEST.

- Best Trading Window: The most active and liquid trading occurs within the first 1–2 hours after the market opens — 09:00–11:00 (summer) and 10:00–12:00 (winter) SAST.

- Weekend Trading: The GER30 does not trade on weekends. Brokers may offer CFDs or futures, but these are synthetic markets without real exchange volume.

- Why Traders Like GER30: It combines volatility, liquidity, clear technical levels, and diversification, making it a strong index for both day trading and longer swings.

- Investment Options (South Africa): Exposure to the DAX can be gained through offshore brokerage accounts, international ETFs, feeder funds, or US-traded ADRs of major German companies.

- Diversification Benefit: GER30/GER40 provides access to leading sectors in Germany — from automotive and tech to healthcare and finance — offering both growth and stability.